Financial review

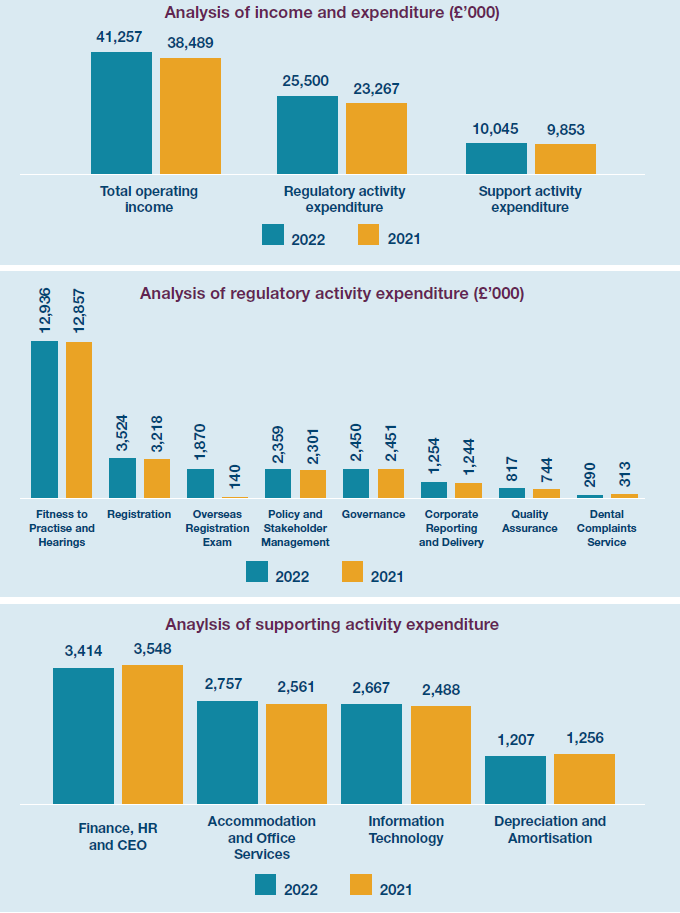

The table below shows our expenditure split by regulatory functions.

| 2022 | 2021 | |

| £'000 | £'000 | |

| Operating income | ||

| Registration fees | 39,732 | 38,480 |

| Exam fees | 1,511 | - |

| Other operating income | 14 | 9 |

| Total | 41,257 | 38,489 |

| Operating expenditure by activity | ||

| Regulatory activities | 25,500 | 23,267 |

| Support activities | 10,045 | 9,853 |

| Total | 35,545 | 33,120 |

| Operating surplus | 5,712 | 5,369 |

| Taxation | 881 | (537) |

| Investment income and adjustment | (3,083) | 2,020 |

| Other comprehensive income | - | 4,490 |

| Retained surplus | 3,510 | 4,490 |

Of our operating income in 2022, 71.7% was dedicated to delivery of regulatory activity (2021: 70.2%), 24.9% was utilised for essential enabling functions (2021: 26.0%) and 3.4% utilised for other non-cash expenditure (2021: 3.8%).

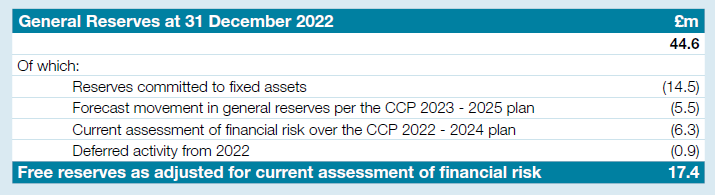

Reserves

Total reserves held at 31 December 2022 were £48.4m (2021: £44.9m), of which general reserves were £44.6m (2021: £38.3m).

At 31 December 2022, we held £30.1m of liquid and immediately available uncommitted reserves (“free reserves”). In common with other healthcare regulators, we hold free reserves to ensure that our regulatory activities can continue through any period of unforeseen reduction in income or increased expenditure (financial risk).

Our current most significant risk relates to the volatility we are seeing in the external economic environment around inflation and the impact that may have on our baseline expenditure budgets. Given the current unpredictability of the economy and the wide range in economic forecasters predictions, particularly around UK inflation, we may need to access free reserves to ensure the ongoing financial viability of the organisation alongside any reprioritisation of our planned activity.

Our free reserves are also held to mitigate against any slippage/deferment of our operational activity between years, short-term fluctuations in the value of our investment portfolio and defined benefit pension scheme obligations. Any short-term fluctuations in financial valuations can impact the value of free reserves at our disposal year-to-year. For 2022, we estimate we have deferred activity to the value of £0.9m for FtP regulatory activity and completion of our planned research programme which will now complete in 2023.

Our investment strategy and principles are reviewed annually by the Financial and Performance Committee to ensure the level of investment risk is consistent with the Council’s appetite. Our defined benefit pension scheme obligations represent a long-term financial risk. The Council continues to look to mitigate and manage this risk through financial opportunities to de-risk the scheme.

Our current approach to budgeting minimises the level of contingency budget we hold for financial uncertainty. Instead, we set any potential financial risk and uncertainty in expenditure against free reserves. This means that there is now a greater probability of the need to call against free reserves, than there would have been previously.

Our reserves policy was last reviewed and agreed by Council in October 2022 and was set with reference to the level of financial risk facing our organisation. Council aim to manage our reserves at a level that is neither excessive nor places our solvency at risk.

Council’s approved Reserves Policy has regard to the:

Objectives of the Council in pursuit of our statutory and regulatory responsibilities.

Funding working capital and management of day-to-day cash flows of the Council, where income is concentrated in summer and winter peaks.

Risks to the income and expenditure of the Council.

Planned major capital spending programmes.

Our assessment against the CCP 2023 – 2025 plan demonstrates our current expenditure plans would sustain free reserves at 5.1 months of our annual budgeted operating expenditure when adjusted for our current level of weighted financial risk and opportunities (£6.3m).

eGDC

eGDC