Financial review

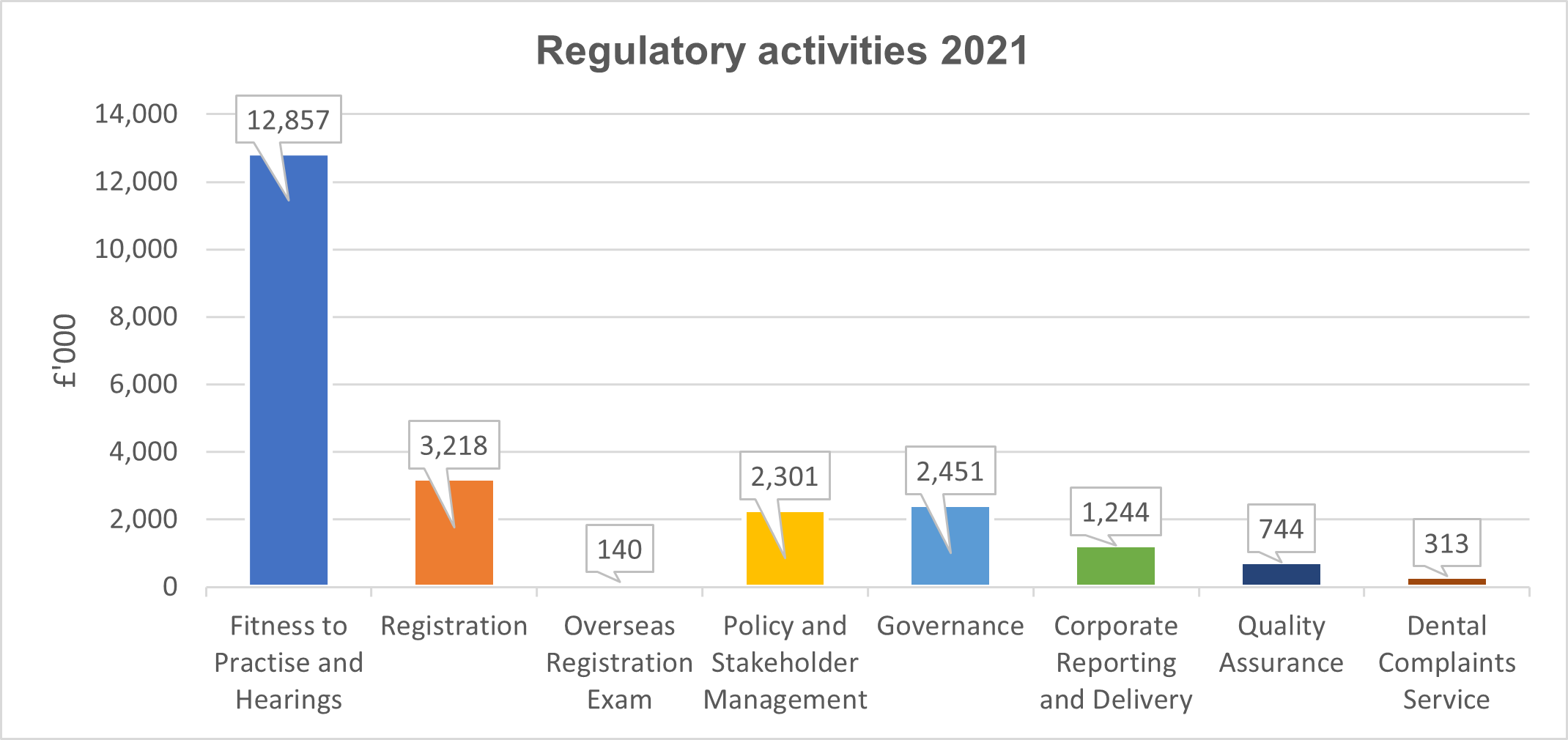

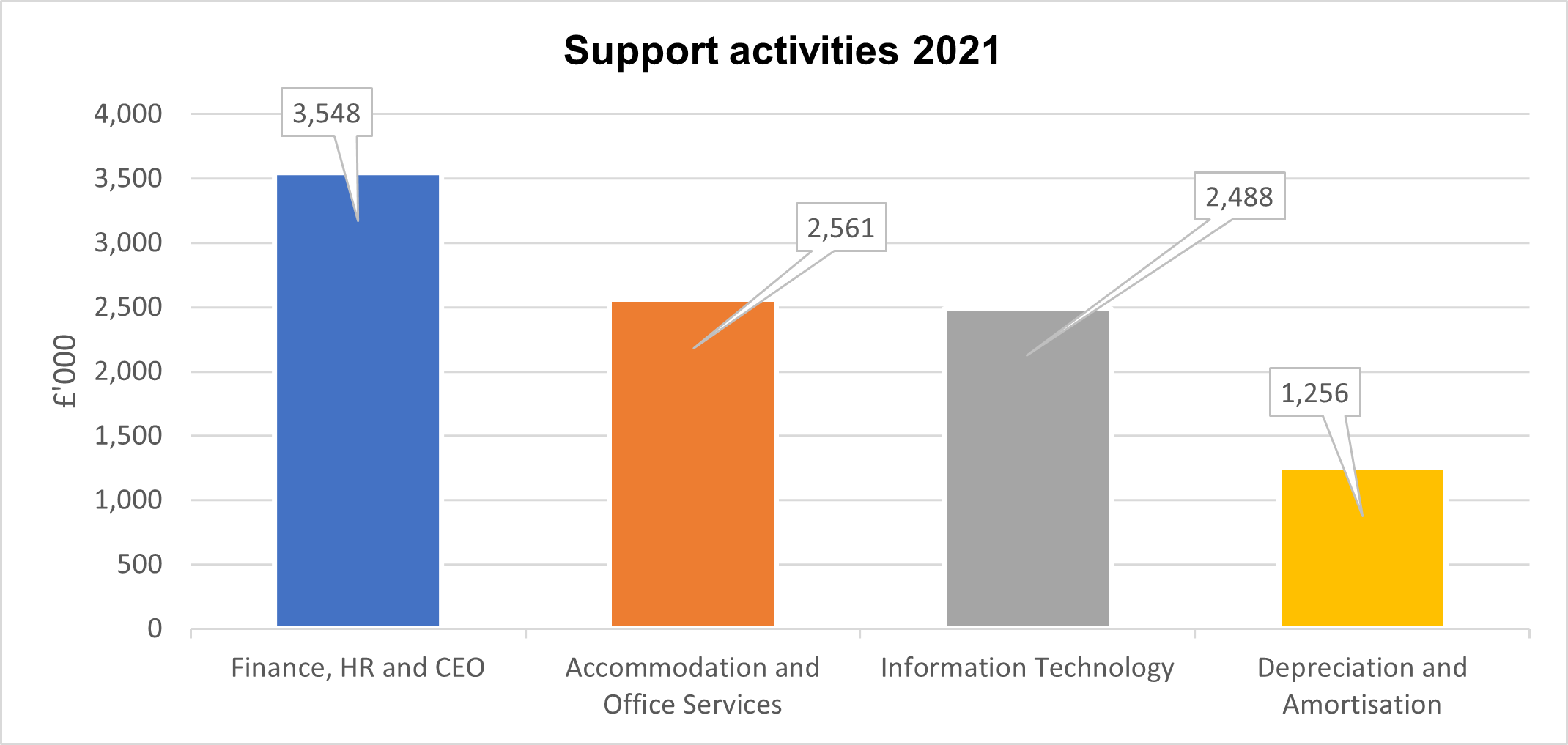

In order to provide stakeholders with additional information the following table shows our expenditure split by regulatory function:

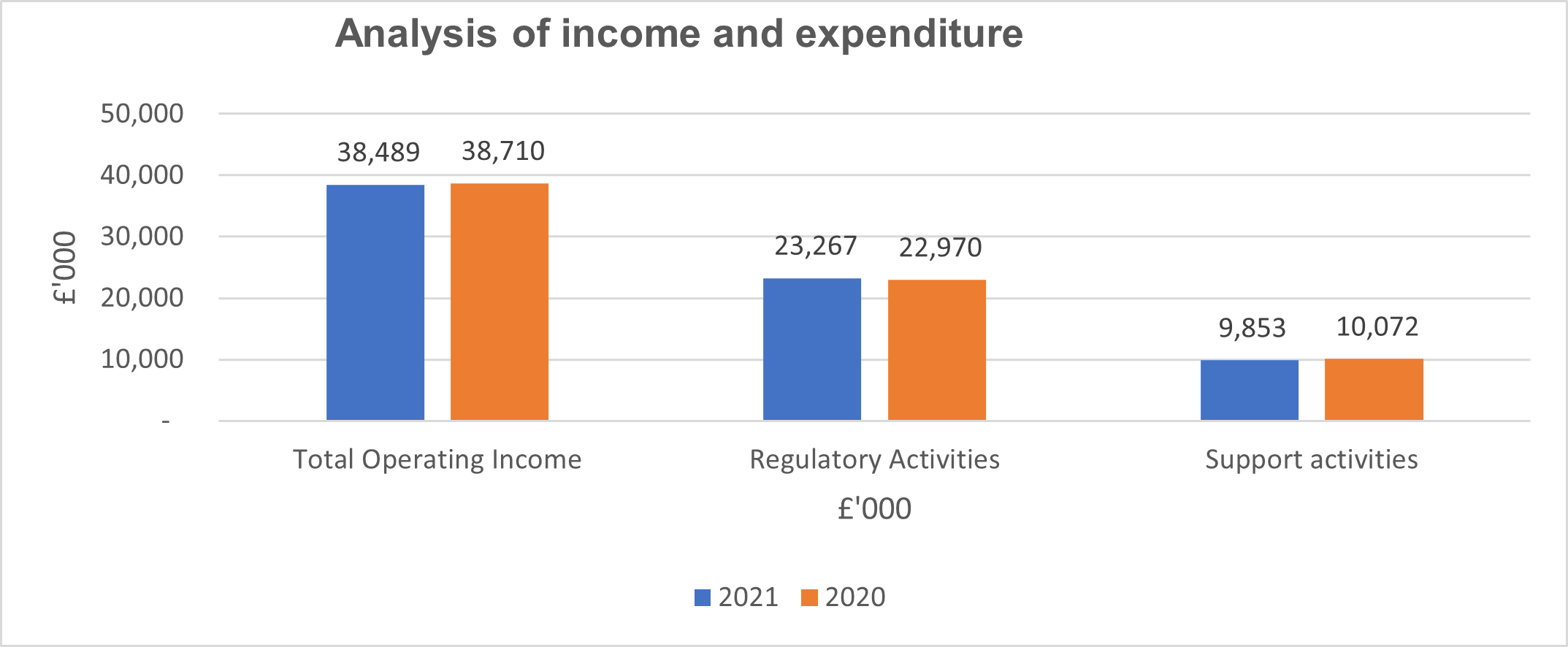

| 2021 | 2020 | |

| £'000 | £'000 | |

| Operating income | ||

| Registration fees | 38,480 | 38,114 |

| Exam fees | - | 422 |

| Other operating income | 9 | 174 |

| Total | 38,489 | 38,710 |

| Operating expenditure by activity | ||

| Regulatory activities | 23,267 | 22,970 |

| Support activities | 9,853 | 10,072 |

| Total | 33,120 | 33,042 |

| Operating surplus | 5,369 | 5,668 |

| Taxation | (537) | (393) |

| Investment income and adjustment | 2,020 | 1,877 |

| Other comprehensive income | (2,362) | (5,216) |

| Retained surplus | 4,490 | 1,936 |

Of our income in 2021, 70.2% was dedicated to delivery of regulatory activity (2020: 69.5%), 26.0% was utilised for essential enabling functions (2020: 24.7%) and 3.8% utilised for other non-cash expenditure (2020: 5.8%).

Reserves

Total reserves held at 31 December 2021 were £44.9m (2020: £40.4m), of which general reserves were £38.3m (2020: £35.9m).

At 31 December 2021, we held £23.0m of liquid and immediately available uncommitted (“free reserves”). In common with other healthcare regulators, we hold free reserves to ensure that our regulatory activities can continue through any period of unforeseen reduction in income or increased expenditure (financial risk).

With our operating income being mostly raised from fees paid by dentists and DCPs, a significant risk is the potential for that income to drop suddenly due to factors outside of our control. Another area of current significant risk relates to the volatility we are seeing in the external economic environment around inflation and the impact that may have on our baseline expenditure budgets. For these reasons, and alongside any reprioritisation of our planned activity, we may need to access free reserves to ensure the ongoing financial viability of the organisation.

Our free reserves are also held to mitigate against any short-term fluctuations in the value of our investment portfolio and defined benefit pension scheme obligations. Any short-term fluctuations in valuations can impact the value of free reserves at our disposal year-to-year.

Our investment strategy and principles are reviewed annually by the Council to ensure the level of investment risk is consistent with Council’s appetite. Our defined benefit pension scheme obligations represent a long-term financial risk. The Council is actively looking to mitigate and manage this through a de-risking strategy. The latest activity in de-risking the scheme was its closure to future accrual in March 2021.

Our current approach to budgeting minimises the level of contingency budget we hold for financial uncertainty. Instead, we set any potential financial risk and uncertainty in expenditure against free reserves. This means that there is now a greater probability of the need to call against free reserves, than there would have been previously.

Our reserves policy was last reviewed and agreed by Council in October 2021 and was set with reference to the level of financial risk facing our organisation. The aim of Council is to manage our reserves at a level that is neither excessive nor places our solvency at risk.

Council’s approved Reserves Policy has regard to the:

- Objectives of the Council in pursuit of our statutory and regulatory responsibilities.

- Funding working capital and management of day-to-day cash flows of the Council, where income is concentrated in summer and winter peaks.

- Risks to the income and expenditure of the Council.

- Planned major capital spending programmes.

Our assessment against the CCP 2022 - 2024 plan completed in February 2022, demonstrated our current expenditure plans would sustain free reserves at 4.0 months of operating expenditure when adjusted for our current level of financial risk (£12.0m).

| General reserves at 31 December 2021 | £m |

| 38.3 | |

| Of which: | |

| Reserves committed to fixed assets | (15.3) |

| Forecast movement in general reserves per the CCP 2022 - 2024 plan | 2.4 |

| Current assessment of financial risk over the CCP 2022 - 2024 plan | (12.0) |

| Free reserves as adjusted for current assessment of financial risk | 13.5 |

| Free reserves expressed as number of months of annual operating expenditure | 4 |

In setting a target level, Council considered that free reserves at a minimum of three months of operating spend and maximum of six months is appropriate, with a target to be four and a half months of operating expenditure as adjusted for our current assessment of financial risk, by the end of our current three-year plan of strategic activity. Our current forecast level of free reserves is currently less than our target but within the range allowed under our Reserves Policy.

This policy will continue to be reviewed annually to ensure it remains appropriate in light of our increased focus on medium term financial planning challenges and estimates.

eGDC

eGDC